are funeral expenses tax deductible in 2020

While the IRS allows deductions for medical expenses funeral costs are not included. Burial or funeral expenses includi.

Are Funeral Expenses Tax Deductible It Depends

As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible.

. Funeral Costs as Qualifying Expenses The costs of funeral expenses including embalming cremation casket hearse limousines. Funeral expenses are not tax-deductible. To claim funeral expenses on your tax return the deceased must be a relative or an ancestor.

What funeral expenses are tax deductible. Individuals cannot deduct funeral expenses on their income tax returns. In short these expenses are not eligible to be claimed on a 1040 tax.

Funeral expenses when paid by the decedents estate may be taken as a deduction on a decedents estate tax return said. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Conditions for Cremation Tax Deductibility.

For most individuals this means. The IRS deducts qualified medical expenses. Any family members out-of-pocket expenses for your.

That depends on who received the death benefit. According to the IRS funeral expenses including cremation may be tax deductible if they are covered by the deceased persons estate. The 300 of expenses incurred.

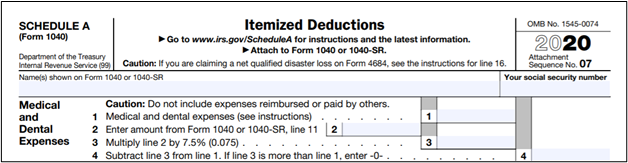

Funeral expenses are generally not tax-deductible unless the deceaseds estate pays for the costs. According to Internal Revenue Service guidelines funeral expenses are not deductible on any individual tax return including the decedents final return. The personal representative may file an amended return Form 1040-X for 2020 claiming the 500 medical expense as a deduction subject to the 75 limit.

The IRS does not levy taxes on most estates so only the most prosperous can benefit from tax deductions on their funeral expenses. Can funeral expenses for my mother who was 96 years young and on Medicare and Medicaid such as pre-plan funeral costs and a monument be deducted on my 2020 taxes. 7021 hollywood blvd los angeles ca 90028 1 301 202-8036 6335 Green Field Rd.

Up to 10000 of the total of all death benefits paid other than. Individual taxpayers cannot deduct funeral expenses on their tax return. Are Funeral Expenses Tax Deductible In 2021.

This includes parents grandparents siblings and. However only estates worth over 1206 million are eligible for these tax. But for estates valued above 114 million in 2019 or 1158 million in.

Unit 1712 Elkridge MD 21075 USA. Qualified performing artists. Funeral expenses are not tax deductible because they are not qualified.

IRS rules dictate that all estates worth more than 1158 million in the 2020 tax year are required to pay federal taxes at which point they can take advantage of tax deductions on the funeral expenses of a loved one. Regulated Funeral Plan Providers Dignity Funeral Plans. The short answer is no.

IR-2020-217 September 21 2020. Funeral and burial expenses can be deducted if they were paid out by the estate of the deceased person. No never can funeral expenses be claimed on taxes as a deduction.

Funeral and burial expenses are only tax-deductible when paid by the decedents estate and the. A death benefit is income of either the estate or the beneficiary who receives it. WASHINGTON The Internal Revenue Service today issued final regulations that provide guidance for decedents estates and non-grantor.

Pin By Megan Lane On Color Beautiful Blooms Bloom Flower Garden

How To Handle Medical Expenses Including Marijuana On Your Tax Return Oregonlive Com

Irs Issues Proposed Regulations On Trust And Estate Deductions

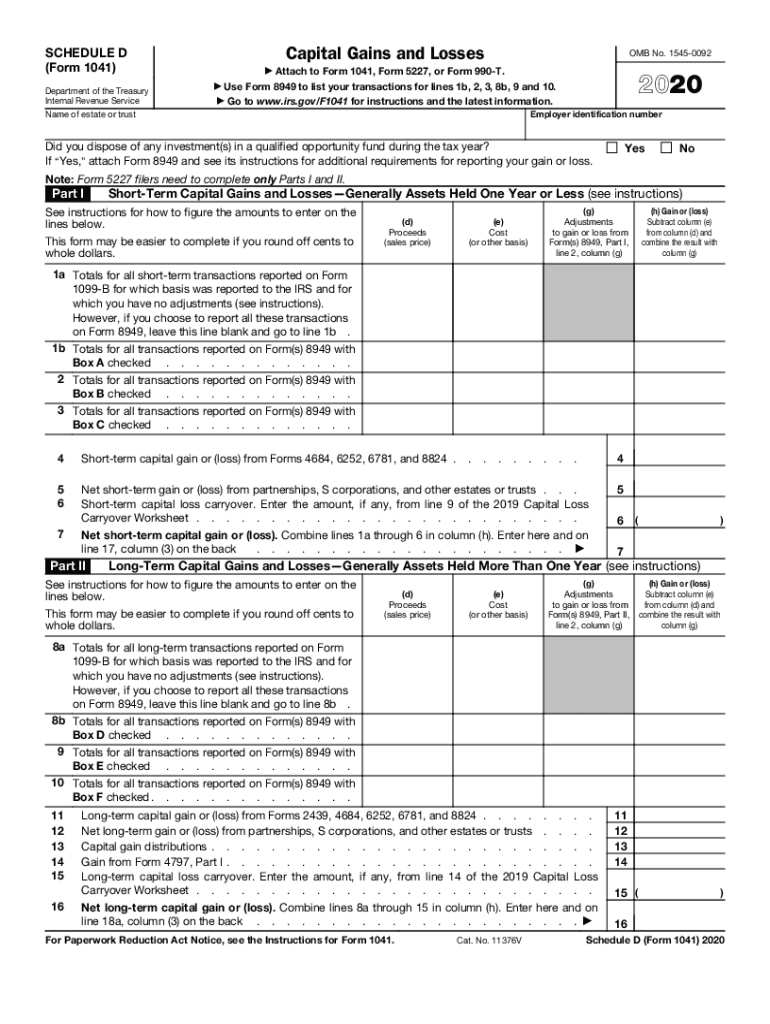

Irs 1041 Schedule D 2020 2022 Fill Out Tax Template Online Us Legal Forms

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

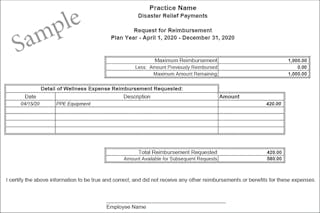

Utilize Tax Free Covid 19 Reimbursements For You And Your Staff Dental Economics

Are Funeral Expenses Tax Deductible It Depends

Health Insurance Nevada Is Leaving Healthcare Gov In 2020 Health Insurance Health Insurance Coverage Health Insurance Plans

Solved Solve The Following Problems Base On The Business Taxation Laws Of Course Hero

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Taxpayers Claim Nearly 17 000 Per Year In Medical Expenses

Irs Announces Higher Estate And Gift Tax Limits For 2020

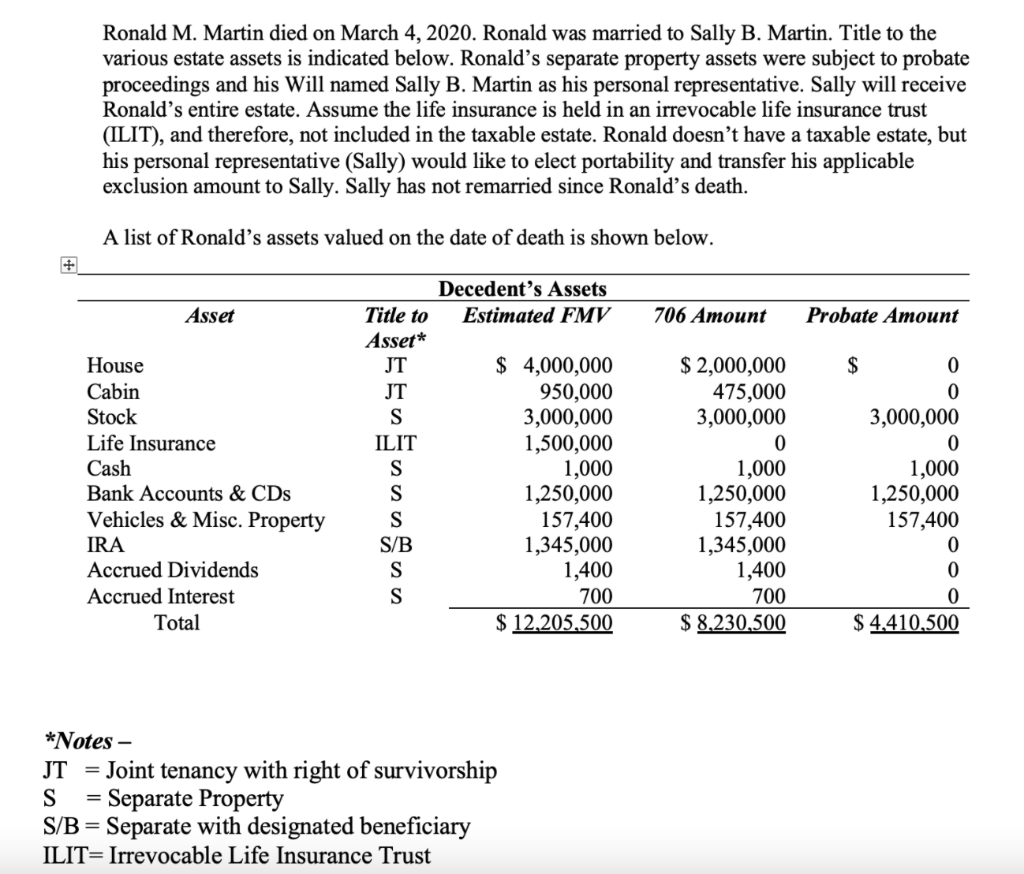

Ronald M Martin Died On March 4 2020 Ronald Was Chegg Com

Covid 19 Funeral Assistance Mema

Amber Wedding Seating Chart Template Printable Seating Etsy Seating Chart Wedding Template Seating Chart Wedding Wedding Posters

Year End 2020 May Not Be The Same As Last Year For Payroll Taxes And Compensation